Home Mortgage – 5 Ways to Boost Your Credit Score

January 30, 2019 12:07 pmHome Mortgage: 5 Ways to Boost Your Credit Before You Apply

The home buying process doesn’t begin when you walk through your first open house – it starts long before that. One of the first steps to home ownership is figuring out your finances, and that includes understanding your credit, a critical piece of the buying puzzle.

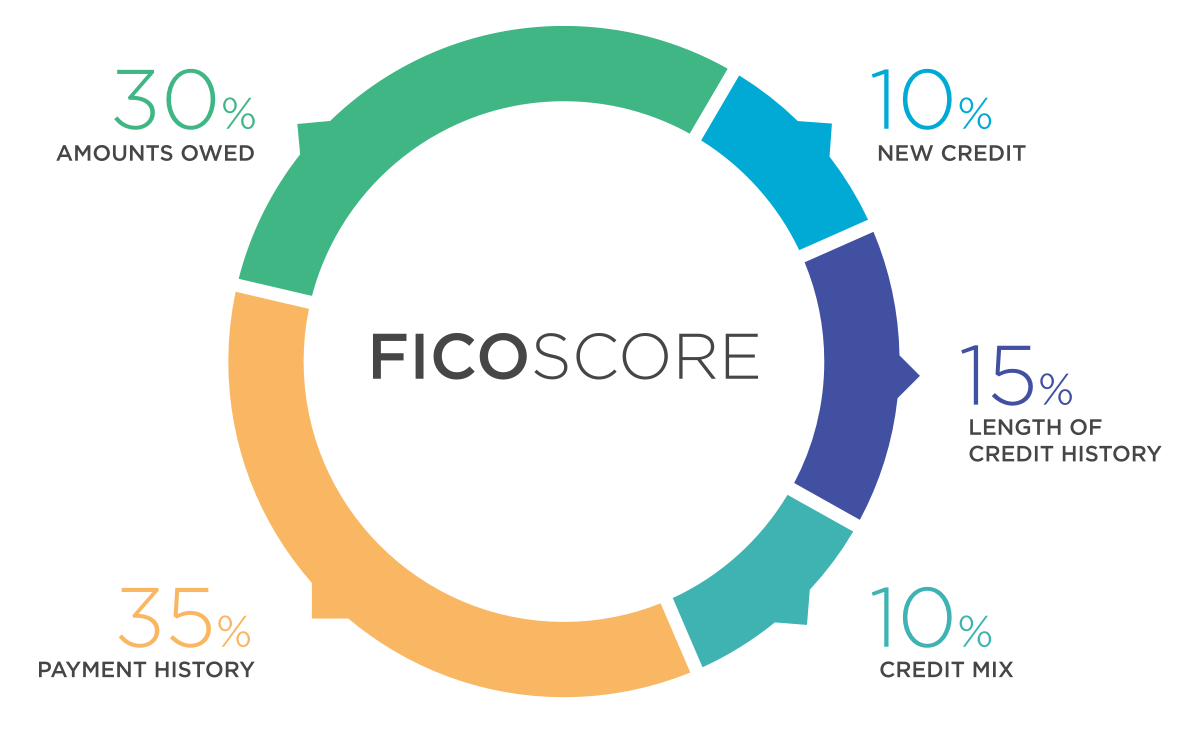

You will often see your credit score referred to as a FICO score. This three-digit number, running anywhere from 300-850, is calculated by combining your payment history, outstanding debts, length of credit history and more, to determine if you are a good risk for any financial lender.

Problems arise when your score falls below approximately 650. However, if you feel like you might fall short of your dream of homeownership due to less than stellar credit, don’t worry because you’re not alone. The national average credit score is 704. Which leaves less than half of consumers in the range that lenders desire most. Although you certainly can get a mortgage with that score, you’ll need a 740 or higher to get the best rates, and while credit history isn’t built overnight, there are still some things you can do right now to boost your credit score—fast:

1. Check Your Credit Report for Any Mistakes

If you haven’t already done so, get your credit report now. Every year, a whopping 20% of people nationwide report errors in their credit profile. (And by “errors,” I mean inaccuracies). You need to be aware that errors exist before you can solve them – and credit issues take time to correct. You’re entitled to a free report annually from each of the three credit bureaus under the FACT Act; just go to www.annualcreditreport.com to retrieve it.

Estimated time for Improvement: One to two months

2. Pay Down Your Balances & Keep Them Low

Paying down your debt can have the biggest – and fastest – impact on your credit. Credit utilization (or the amount you’re qualified to borrow versus the amount of debt you have) accounts for 30% of your credit score. And the more available credit you have, the better.

If you have the cash on hand, try to time your payments so you’re reaping the credit-reporting benefits. The easiest way to optimize your utilization is to pay your balance down to less than 30% right before your bank reports to the credit bureaus. You can find out when your creditors report by calling them up and asking, or you can check your credit report.

Estimated time for improvement: One month

3. Pay Your Bills on Time!

It sounds like a no-brainer, but if you’re looking to increase those scores over time in a clear and steady upward climb, never miss a payment. If you’re already late, pay that bill ASAP along with any penalties for a quick credit boost. Plus, if you’re less than 30 days late when you pay you should be in the clear. Creditors don’t typically report until after the 30-day mark.

Additionally, make more than just the minimum payments on your revolving credits each month. A history of minimum-only payments isn’t an ideal indicator for anyone reviewing your credit report. Always pay more – even if it’s just a small amount. You will chip away at your balances faster and save money in the long run by lessening your interest owed.

Estimated time for improvement: One to two months

4. Open a New Account

Opening a new credit account can help in two ways. First, it will increase your total outstanding credit line, thus improving your credit utilization ratio. Secondly, if you have only one type of credit card or a small loan, opening another type (like a store card) can help your “credit mix,” a term used by the credit bureaus to indicate whether a person can handle diverse accounts.

However, don’t overdo it! Try opening just one or two accounts at first. Each time you apply for a credit card, the lending company does an inquiry into your credit history. A high number of recent inquiries will cause you to take a hit on your credit score.

Estimated time for improvement: One to six weeks

5. Become an Authorized User

Have a responsible partner or family member? Becoming an authorized user on one of their accounts will let you piggyback onto their good credit history. The full history of their account will show up on your credit report giving you a helpful boost to your score. And the older their account the better, as it might help extend the length of your credit history. Just be careful to make sure the person you choose pays his bills on time and keeps the debts low – just like good credit history, bad history will show up, too.

Estimated time for improvement: Immediately

Bonus Tip: No Major Purchases Equals No Hard Inquiries

Avoiding any big financial changes before purchasing a home is a smart decision. That means no big purchases on credit, like buying a car or charging an expensive vacation. Any significant buys can alter your financial picture, and banks don’t like to see sudden changes just before approving a loan.

Tags: Hermosa, hermosa beach, home buyer, manhattan beach, new construction, palos verdes, Palos Verdes Real Estate